Medicare Supplement Plans

Medicare Supplement or Medigap, is plan coverage offered through private insurers that pays for most of your out-of-pocket costs like deductibles and co-pays. It picks up where Original Medicare stops and covers many of the things that Original Medicare does not. Medicare Supplements have 10 sub-plans. Since the government standardized the Medicare Supplement plans in 1992, each supplement policy with the same letter must offer the same basic benefits, regardless of which company is offering the plan.

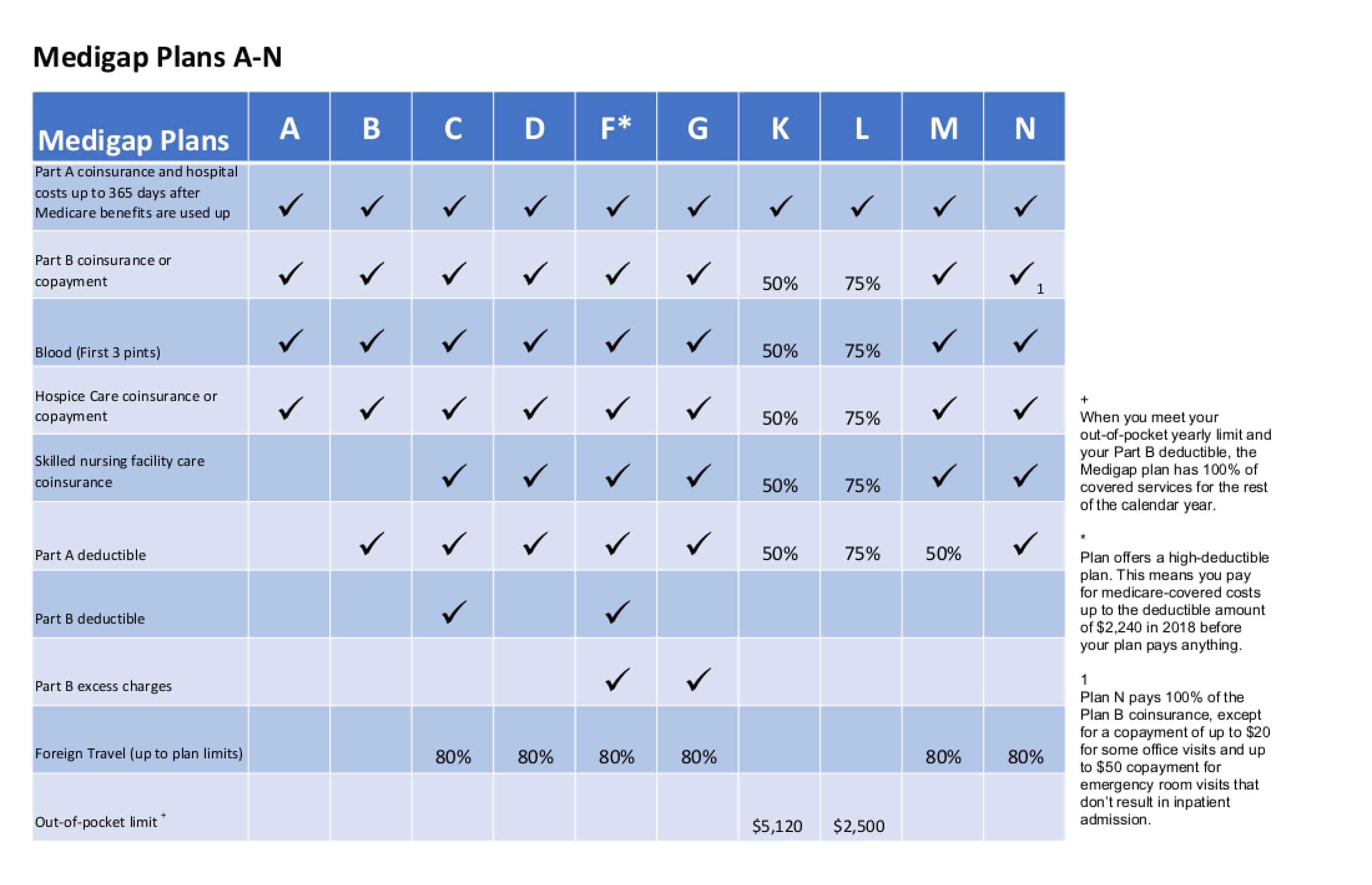

The 10 standard Medigap plans are marked by the letters A, B, C, D, F, G, K, L, M, N. Once enrolled in a Medicare Supplement, your plan will pick up the portion of your bill, after Original Medicare has paid its claims. Keep in mind, Medicare Supplement plans do not cover prescription drugs – that’s where Medicare Part D comes into play.

As you can see from the chart, each plan will cover the gaps in Original Medicare differently.

For example, Plan F covers the Part B Deductible, but Plans G and N do not. If you are confused about the chart and would like to speak with someone about the best option for you, please give us a call or schedule a consultation.

Ready for a consultation?

Free Call. No Obligation.